Indústria de Consumer Goods quer driblar varejo e Amazon via venda direta ao consumidor

É uma rebelião? hummm, nem tanto. Trata-se de um jogo estratégico qu está em amrcha não é de hoje, mas o fato é que a dependência de markeplaces e mesmo do historicamente parceiro de negócios varejo, vem incomodando cada vez mais as indústrias, que hoje via estratégias omnichannel conseguem ir direto ao consumidor.

Não é de hoje que acompanhamos o movimento de fabricantes de vários setores da indústria experimentando alternativas de venda e distribuição que deem um bypass na intermediação da cadeia de varejo e buscando a venda direta ao consumidor final.

Não é fácil para as indústrias fazerem isso. por um motivo muito simples: elas precisam incorporar vários elos da cadeia que durante séculos foram ocupados e ativados por uma complexa rede de logística, distribuição, ativação e vendas, que simplesmente chamamos de varejo.

Trazer para si essa responsa implica em investimentos consideráveis e o desenvolvimento interno de estrutura e recursos (práticas, operações e pessoas) que certamente impactam forte na gestão e nos custos das companhias.

O mundo digital e a crescente eficácia do sistema omnichannel, que barateia e incrementa a cadeia de distribuição, tem animado setores industriais a sonharem com o D2C, ou direct to consumer, ou direto ao consumidor.

Este breve estudo do eMarketer captura um incremento dessa vontade junto aos fabricantes de consumer goods, aqueles produtos de algo consumo massivo cotidiano, segmento responsável por grande parte do movimento do varejo em qualquer parte do mundo.

Uma das razões dessa tendência, além do omnichannel em si, é o crescente poder de markeplaces como Amazon, eles mesmos onipresentes em todos os touch points do consumo, agora até na mídia, já que players como Amazon e Wallmart ingressam pesado no mundo da comunicação, virando players de advertising, e aumentando ainda mais a dendência dos fabricantes desses mamutes da distribuição venda globais.

Veja abaixo os indicadores dessa briga de cachorro grande e tire suas próprias conclusões.

Consumer Goods Brands Hope to Fend Off Amazon by Investing in D2C

As retail store closures continue at an alarming rate, consumer goods brands have fewer channels to sell their products outside of retail and ecommerce behemoths like Amazon, Walmart and Costco. This reality has many in the consumer goods industry looking to sidestep retail and online marketplaces altogether by selling to their customers directly.

An overwhelming 99% of consumer goods leaders surveyed by Salesforce in February 2019 said that they were investing in direct-to-consumer (D2C) strategies of some kind, leaving 1% who said it was not a priority.

In the current retail and ecommerce climate, it’s no surprise that brands are seeking alternatives to the limited options they have now. Some 42% of consumer goods leaders polled said the challenges of brick-and-mortar retailers were negatively affecting their business. This is perhaps because the same companies that are putting smaller retailers out of business also sell private-label brands online and in-store—leaving consumer goods brands not only with fewer options, but increased competition within search results and on the shelves next to them.

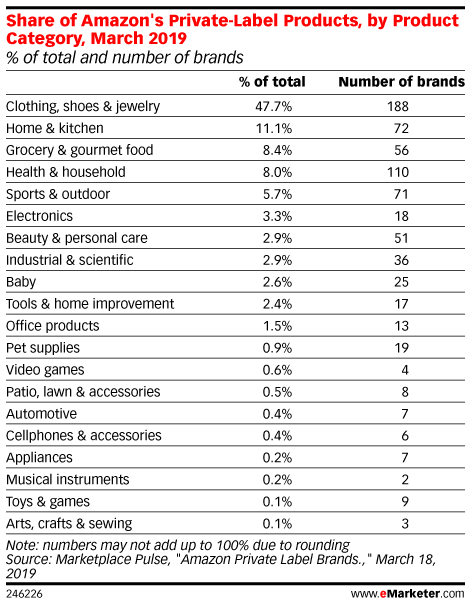

Nearly half of consumer goods leaders said that retailers’ private-label products were seen as a threat to their business, Salesforce found. Amazon in particular has hundreds of private-label brands across virtually every product category, according to a March 2019 study by ecommerce research firm Marketplace Pulse.

Are your Amazon ads being seen? Or are they getting lost in an increasingly crowded and competitive field? Read this eBook from ChannelAdvisor for tips to maximize visibility, eliminate wasted ad spend and boost ROI. You’ll learn techniques for advanced search term mining, strategies for smarter bidding and more.

In the Salesforce survey, 51% of respondents saw Amazon’s Marketplace (where products are purchased through Amazon, rather than purchased by Amazon at wholesale cost) as a critical threat, and 68% believed that consumers were more loyal to Amazon than their own brands.

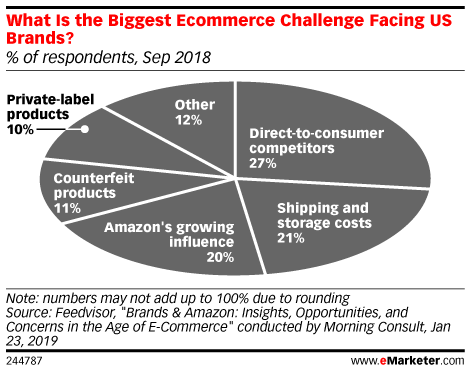

Traditional consumer goods brands face another hurdle: competition from native D2C brands that have already won over a large online audience. US brands said that D2C competitors were a bigger ecommerce challenge than private-label brands and Amazon’s growing influence, according to a September 2018 survey conducted by Feedvisor and Morning Consult.

For some larger consumer goods companies, the idea of investing in a D2C strategy has manifested as acquisitions of the successful startups that disrupt their industry. The recently announced purchase of razor company Harry’s by Schick owner Edgewell Personal Care evokes the age-old business adage: If you can’t beat them, acquire them.