Para a Forrester, o modelo de holding companies de agências é coisa do século passado.

E é mesmo. Do jeito que foi criado, por Martin Sorrell no WPP e depois copiado pelas demais holding companies da propaganda mundial, o modelo é de fato do século XX. Mas a Forrester está, em verdade, ironizando. Não tem preocupação histórica. Quer dizer, em análise ousada, que essas estruturas precisam ser alteradas para fazer frente a nova realidade da propaganda mundial, que por sua vez decorre dos novos desafios dos CMOs. Falo isso faz tempo, mas aqui e agora são eles que estão dizendo, não eu, tá? Just in case.

Com o título de Agency Holding Companies Need a Brave New Business Model, a Forrester deixa de lado seu tom mais objetivo e técnico, para ser analiticamente crítica em seu estudo sobre os desafios dos CMOs, suas angústias e novas metas sobre o modelo de negócios da propaganda mundial.

Pega mais pesado com o WPP, que entende como aquele que tem o modelo menos preparado para o futuro (a discutir, devo dizer), mas não deixa nenhum dos demais de fora.

Em sua lógica, o instituto de pesquisa, que agora resolveu dar uma de Accenture e McKinsey, só que com uma pegada mais ácida, acredita que o WPP deve se reorganizar em silos verticais por disciplina e atividade de negócio, juntar um monte de agências sob guarda-chuvas de marcas mais fortes, enxugar sua rede e por aí vai.

Bom, informações de bastidor dão conta que o grupo está fazendo exatamente isso. Inclusive aqui no Brasil.

Se o WPP concorda ou não com a Forrester, não vem a caso, mas está sim implementando algo bem parecido com o que sugere a empresa de pesquisa. Rã, consultoria. Rã, sei lá.

Temos comentado há anos aqui que o modelo das agências precisa ser revisto e agora a Forrester pega forte na crítica a ele, entendendo que várias ameaças, que estão listadas aí abaixo.

Os caras copiaram descaradamente todos os meus argumentos, mas não se preocupe leitor (a), que eu depois me acerto com eles.

Um deles é este aqui … que o CMO vão ter que se preocupar com o que de fato nunca se preocupou, que é o efetivo crescimento da companhia que paga o seu salário, e que por isso, vai ter que entender de vendas, varejo e criação de valor ao longo do tempo (CMOs ficam em seus cargos em média 3 anos e se pirulitam para outro emprego, não dando tanta atenção assim a construção de valor, mas a coquista de metas de curto prazo, até porque são elas que garantem seus bônus). O impacto disso nas agências é que elas também te~roa que fazer sua migração para um mundo que absolutamente desconhecem (varejo? vendas? blaaarghhh!) … This focus on growth requires agencies to help marketers connect all marketing activity to business outcomes like sales and lifetime value.

Resumindo, a lógica básica é a seguinte: os desafios do CMOs vão resultar, inevitavelmente, na dissolvição do modelo de holding companies. Ponto. Fim da história.

Tirei o pedaço que me pareceu mais diretamente ligado ao interesse das agências, mas a leitura completa do estudo, que você pode acessar aqui, é absolutamente indispensável.

The CMO’s Growth Agenda Disrupts Agency Economics

The current environment places the CMO under pressure; she can either assume the mantle of Growth or watch her influence wane as another member of the C-suite, such as a chief growth officer, takes it on.1 As the CMO’s responsibility expands beyond building and communicating brands to also include driving sales and customer value, the traditional role of agencies and their media-led business models come under attack. They must flex to meet the CMO’s growth agenda. Five growing forces disrupt agencies’ existence:

1. CMOs advance in-house agencies. Many CMOs create in-house agencies for cost effectiveness, control over customer data, and transparency.2 A Forrester/In House Agency Forum survey found that 64% of respondents use in-house agencies for some services in 2018, an increase of 52% from a decade ago; this includes the 70% of marketers who command strategy and campaign direction in-house for programmatic advertising.3 Unilever claims its decision to shift some production resources to its in-house agency resulted in a 30% saving in marketing spend.4 Shifting a controlling share of budgets in-house pressures agencies to partner omnivorously with their clients simply to justify their existence.

2. Companies seek to serve customers everywhere around the world. CMOs of firms pursuingtransformation require teams and the ability to execute a customer-first strategy across multipleregions and markets. Marshalling budgets, talent, and partners globally is critical for consistency and implementation. One brand marketer told us that a global partner to help build best-inclass capabilities and scale isn’t realistic in the current agency structure. This puts pressure on agency holding companies to work across their agencies’ different P&Ls, despite the obstacles or resistance to delivering services for every channel consistently around the world.

3. CMOs aggressively manage costs, especially media. Firms push steady budget cuts, challenge fees, and force account reviews to drive down the rising cost of marketing. “The cost of marketing is significantly increasing from the expansion of touchpoints, the price of media, content, data, technologies, and agency fees,” says Colin Kinsella, CEO of Havas Media. This puts pressure on agencies to trim and justify costs. The result? Agencies discount labor costs, restrict the scope of work, or manage margin through fees — challenging client trust and letting budget negotiations influence the quality of the services delivered and client outcomes.

4. Consultancies ascend on high-margin marketing services. Global management consultancies are coming after the lucrative agency business with multiyear experience and transformation services. Accenture Interactive, Deloitte Digital, and IBM iX now rank among the largest agencies. Brian Whipple, head of Accenture Interactive, says, “The larger transformation is what we are interested in, not just advertising campaigns that are only part of the experience.” This focus propelled Accenture Interactive to 50% growth and $4.4 billion in agency service revenues in 2017.5 This is forcing agencies into a defensive posture, protecting their core media and creative competencies while surrendering any advance into complex technology implementations as CMO spend continues to shift into customer experience and martech.6

5. Company growth agendas involve more stakeholders. Business stakeholders, from product teams to customer care, pursue their own agencies or relationships with consultancies. And while CMOs have the fastest-growing technology budget, CIOs are more involved in agency deals ecause technology plays such a vital role in execution.7 An agency executive told us marketing owned only half the “content” budget at one global technology company. These new stakeholders prioritize specific vendor capabilities over CMO client relationships or the agency’s knowledge of the business. This has altered the purchase patterns for services traditionally considered table stakes for the weakening agency-of-record relationship. It Also Poses An Existential Threat To Agency Holding Companies What role must agency holding companies play in a CMO’s new reality? How should they respond to these new threats? What’s their raison d’être? Dentsu Aegis Network, Havas Group, Interpublic Group of Companies (IPG), MDC Partners, Publicis Groupe, Omnicom Group, and WPP are hiring or appointing new leaders, streamlining their organizations through consolidation, and building new data businesses. Our take: It’s not enough. Leadership changes and bolt-on businesses alone won’t overcome the existential threat of:

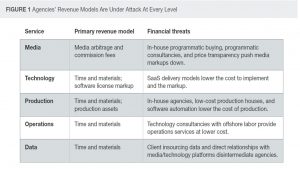

›› Disrupted revenue models. The lack of clear financial alignment and cross-network incentives

in many holding companies prevents them from seeing and rapidly responding to a CMO’s bigger

needs. Compounding the problem is that traditional agency revenue models like media, production,

and operations face the threats of transparency, automation, and competition (see Figure 1).

Agencies need to develop new sources of revenue. “We stand a greater chance of winning client

business by bridging the CTO/CMO gap and learning one another’s language,” says Carla Serrano,

chief strategy officer of Publicis Groupe.

›› Rigid staffing models. CMOs need the best agency talent on their teams, regardless of where it

is in the world or what organization it sits in. This is especially true of high-demand technology and

data science skills, which still elude most brands. Former Publicis Groupe Chief Data Officer Jason

Kodish describes the difficulty of moving talent through the network: “I once got a call asking for

three-quarters of a data scientist in Turkey for the following Monday!” Agencies must overcome

these structural barriers to staff mobility.

›› Incomplete attribution. Over half of global marketing decision makers see revenue growth as a

top priority for their organization, ahead of improving differentiation or brand reach in the market.8

“Bringing a business-changing idea like a new ordering platform shifts our [marketing] role from

[that of] a cost center to a revenue generator,” explains Mike Nesladek, director of marketing at

TruStile Doors. This focus on growth requires agencies to help marketers connect all marketing

activity to business outcomes like sales and lifetime value.

It’s Time Agency Holding Companies Embrace A New Business Model

To align service and revenue models with the CMO’s growth agenda, agency holding companies

need a new business model that puts clients at the center, fixes financial misalignment, scales critical

capabilities, and blends creative firepower with executional prowess. They have an opportunity to borrow

and adapt pieces of the consulting industry playbook: Put account relationships and delivery teams at the

top, and cultivate the skills and processes to marshal all the agency’s resources to serve the CMO’s entire

growth agenda. To achieve this, the agency holding companies of the future will establish:

›› Agile client teams. CMOs need their agency partners to quickly assemble teams to solve

tough problems, then stand down or swap out specialists as the program’s needs change. One

agency CEO we spoke with described a future in which client teams were pared back for account

consistency and staffed with the best people for that phase of the program. To deliver the best

solution, every client team must be able to use best-of-breed skills and staff, regardless of where

they sit. Agencies must adopt the infrastructure and tools to quickly identify the experts and pull

them off the bench of a less-vital team. One consultancy pulls together a client team on a Friday to

fly around the world to solve a client problem on a Sunday — and sees this as a matter of course,

not heroism.

›› Global practices. Consultancies have nailed this: When they spot an important new service line,

they build a capability practice led by an executive to develop skills, best practices, and assets.

Agencies can go further than they have already and move even more employees into practices

where they can build their discipline and be ready to join an agile client team at a moment’s notice.

One agency holding company executive estimated that half of its employees would be part of a

capability practice in the future. Agencies must go beyond just organizing technology, data, and

media capabilities and create global practices in consulting, performance marketing, and marketing

technology implementation.

›› Coherent brand presence. The days of agency networks with hundreds of agency brands and

tribal cultures are over. CMOs want fewer agency relationships that can solve bigger problems

while addressing client concerns for exclusivity. “We need to be much more client-centric and

more focused on client needs,” says Mark Read, co-COO of WPP. To meet the CMO’s need for

coherence, agencies have two paths forward (see Figure 2).

First, they can adopt a single global brand — Dentsu Aegis Network, Havas Group, and Publicis

Groupe are assembling agency partners under a global go-to-market brand, such as Publicis’

Power of One.9 Alternatively, they can consolidate into a small number of agency brands: IPG, Omnicom Group,

MDC Partners, and WPP are consolidating their agencies into new entities like IPG’s Reprise or

WPP’s Superunion.10